Introduction

Make no mistake: Amazon Vendor Central is a challenging platform.

Seller Central has seen huge traction over the years, with over five million sellers now using the platform globally. But Vendor Central, Amazon’s lesser-known and lesser-used platform, has been left in some kind of late-nineties timewarp.

It’s littered with terminology that few understand, uses processes that leave even those with the highest IQs dumbfounded, and features an interface that belongs in a failed startup. It’s hardly what you’d expect from the world’s most formidable ecommerce operator.

Nevertheless, some are making a success of it. Big brands, like Remington or Sony, are much more likely to be operating as a Vendor than a Seller to get their goods into Amazon.

And there are tens of thousands of other, much smaller brands, that use it too. For various reasons, they’ve decided to supply Amazon on a wholesale basis via Vendor Central, instead of going ‘direct’ to Amazon’s customers through Seller Central.

Those brands are onto something. The businesses making the Vendor model work for them know that it is already, or soon will be, their most important channel.

In recent years, many have seen their traditional distribution models, established retail relationships and the nature of their competition totally upended – by the changing face of retail, the pandemic and, of course, Amazon themselves. But in the midst of all that disruption, their Amazon revenue has kept growing.

That’s not to say their journey has been easy, or that there aren’t more challenges ahead. Amazon Vendor Central isn’t for everyone – but there’s a substantial potential payoff for those that use it well.

This guide will give you a better understanding of why Vendor Central exists, if it’s right for your brand, and how best to leverage its opportunities and overcome its challenges.

A Brief History of Vendor Central

So, why does the Vendor model exist, and why have so many brands chosen it as their preferred channel for getting products on Amazon?

Given the many complexities of the channel, it’s a good question.

There’s a lot of confusion and misinformation out there. When I ask existing Vendors why they’re using Vendor Central, the reasons they give are often mixed at best, and misinformed at worst.

Many jump in without really understanding the nuances of the platform, having a strategy to manage it, or the knowledge or resources to build one. As a result, they’re left struggling, knowing the channel is underperforming, but not sure why, or how to fix it.

A lot throw in the towel, convinced that Vendor Central is simply an inferior model to Seller Central – and in fact, even some independent Amazon ‘experts’ will claim this. But it’s a generalisation that just demonstrates ignorance about what and who the different channels are for.

Where Vendor Central came from

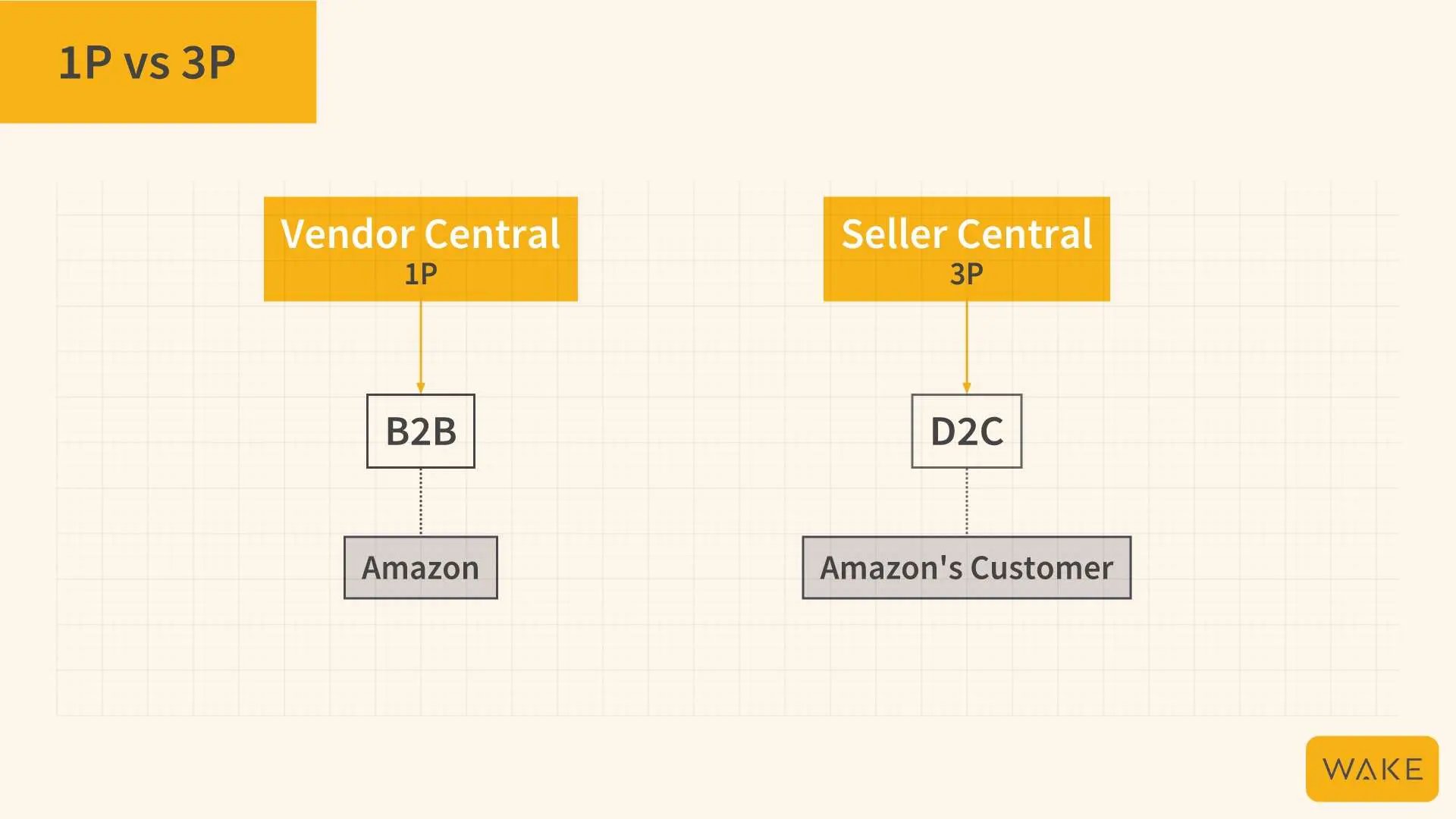

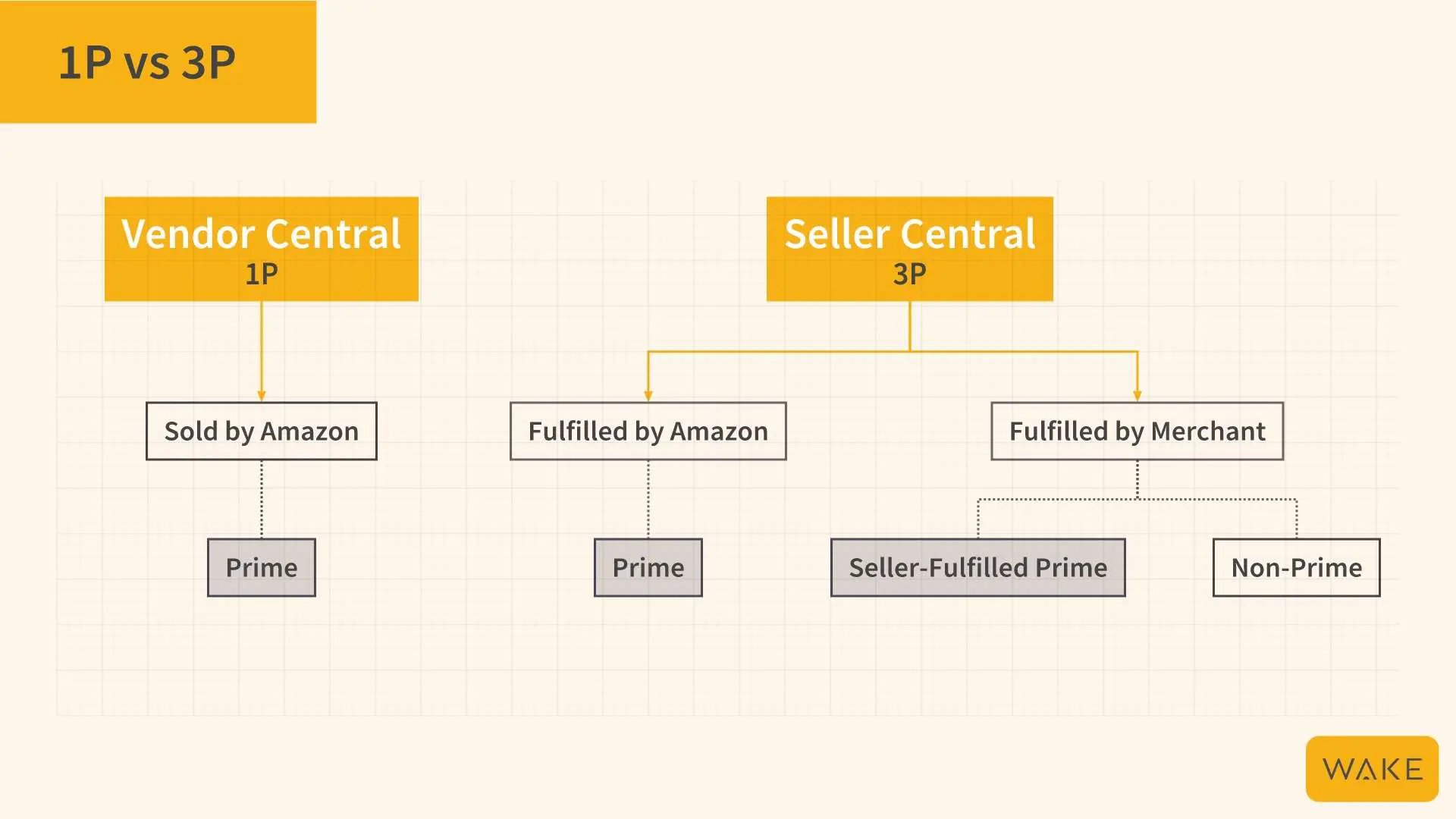

The Vendor, or ‘1P’ (first party) model is actually how Amazon got started. By building relationships with brands and suppliers, Amazon could purchase stock from them, store it in their warehouses, and re-sell it on their website.

But Jeff Bezos knew there was always going to be a limit to the number of brands and products Amazon could physically warehouse, or afford to stock. His long-term vision for the ‘everything store’ didn’t come to fruition until he invited brands to sell on the platform, rather than to the platform.

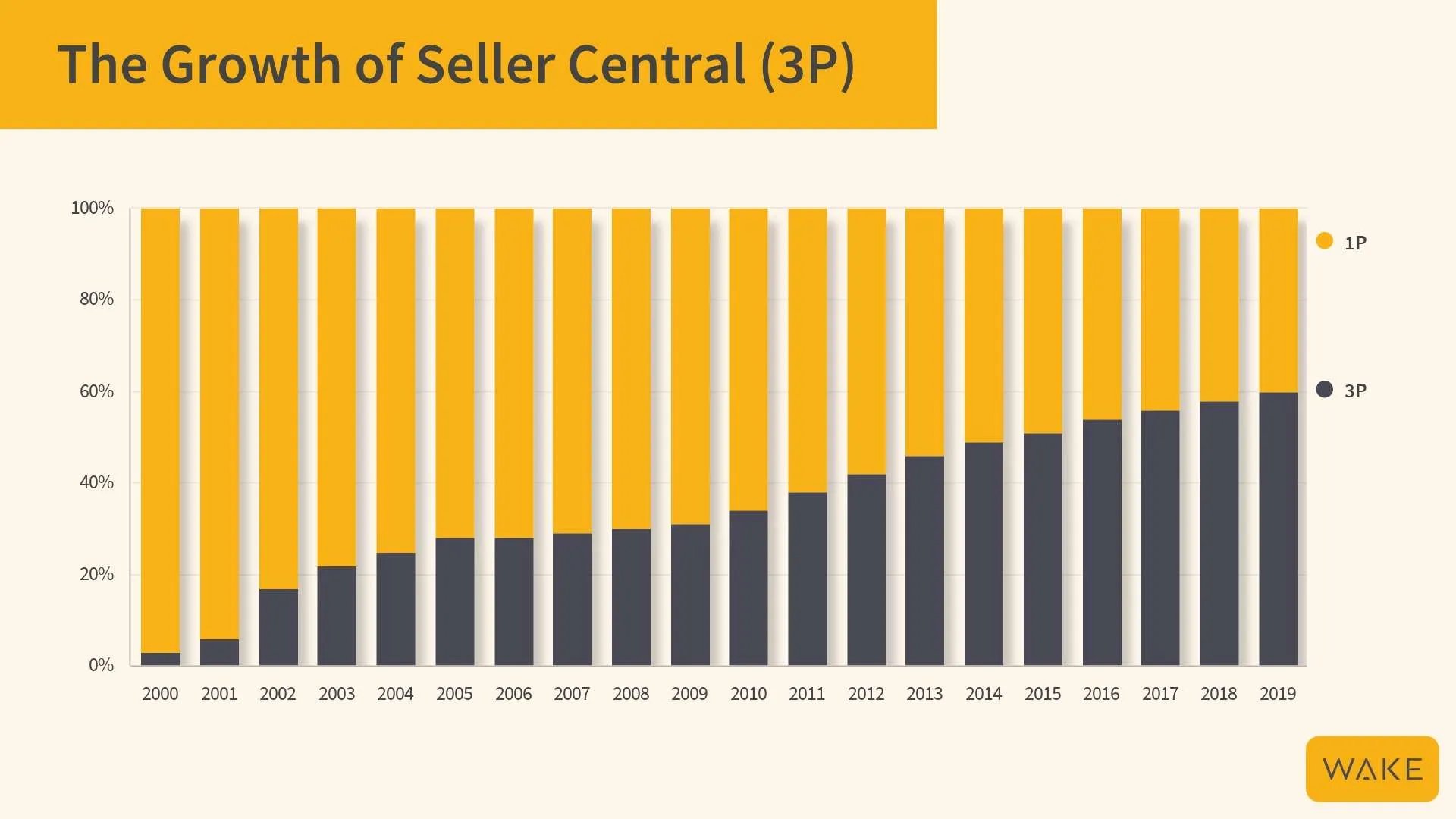

Once Amazon combined its 1P model with Seller Central, the third party (3P) seller marketplace model made famous by eBay, it was able to grow its product selection rapidly. Now, over 20 years later, 3P sellers using Seller Central sell more than Amazon itself.

Where Vendor Central is today

The share of 1P revenue has declined over the years – but Vendor Central still makes up nearly half of all products sold on Amazon, and is responsible for billions of dollars in revenue annually. As I mentioned earlier, huge multinational brands are more likely to be Vendors than Sellers.

There are a few reasons for this, perhaps the most pertinent being the additional amount of brand control Vendor Central offers. Maintaining brand control on Seller Central is becoming increasingly more challenging.

Brands whose products have already found their way onto Seller Central via resellers often struggle to assert their rights as brand owners. Requests to change listings and product details can be ignored, or fall into a black hole of customer support requests.

On Vendor Central, there’s a higher level of support and authority over listings, enabling more control and easier optimisation, which can lead to better overall sales performance and customer engagement for the brand.

New accounts are serviced directly by an Account Manager for the first year. After that, the ones that grow big enough have the option to work with Amazon Brand Specialists (at additional cost), and might also get the attention of Vendor Managers (essentially category managers) if they become a big enough player in their category.

Brands can leverage all this to create strategic relationships that drive performance, as well as find resolutions for specific challenges that won’t be resolved through standard support tickets. This kind of direct relationship simply isn’t available on Seller Central.

The situation for smaller brands is more nuanced. Ultimately, it’s the brands that have the biggest potential to scale and become key players in their categories that see the best results on Vendor Central. Amazon has the infrastructure in place to support scaling brands, and will offer up more of it as brands become more valuable to their platform.

Whilst there are complexities and challenges to Vendor Central, brands of any size would be ill-advised to dismiss it as niche or irrelevant.

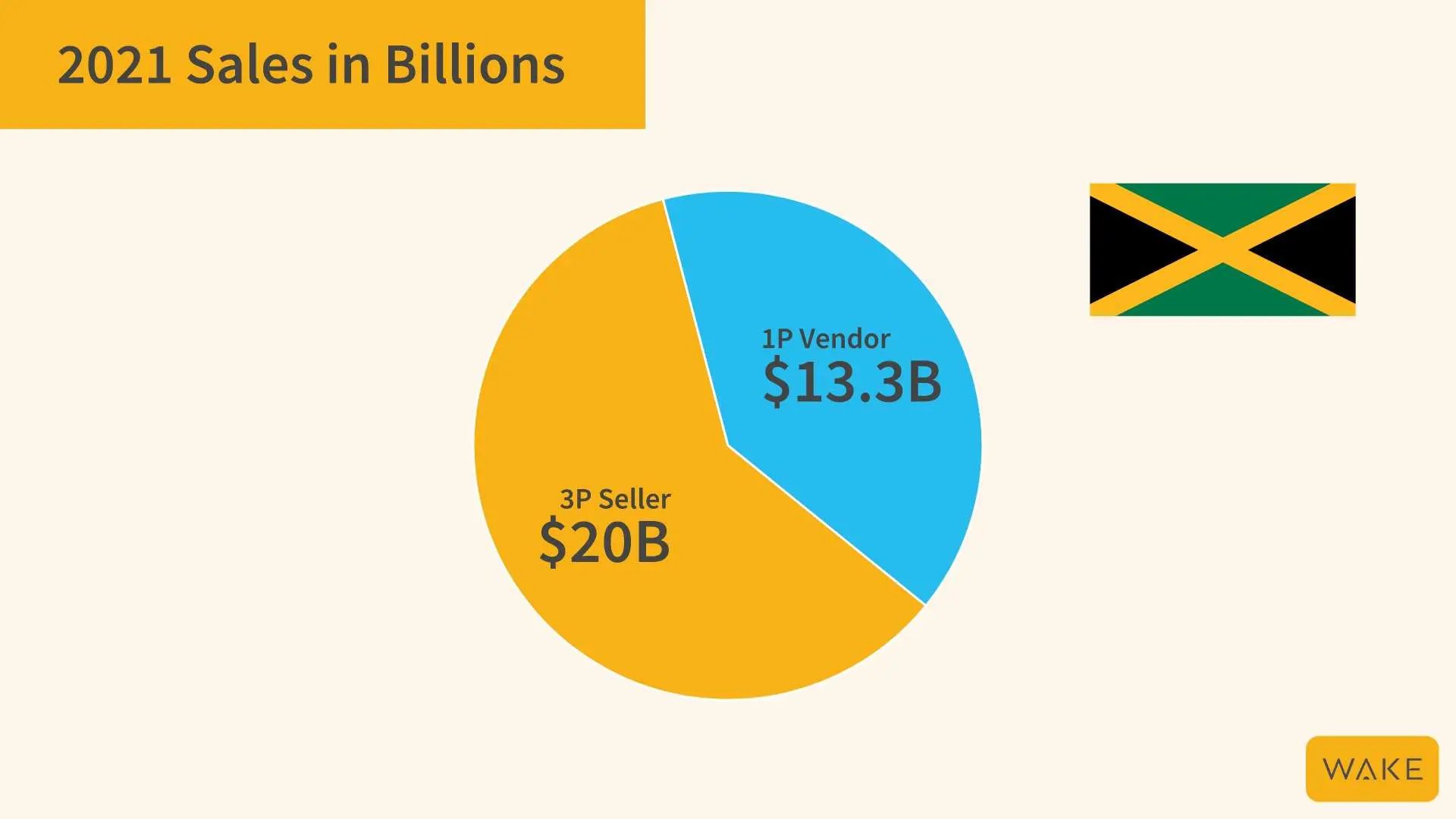

Yes, Vendor Central now accounts for less overall revenue than Seller Central, but it’s still in the multi-billions and comparable with the GDP of Jamaica

What’s next for Vendor Central

Over the years, there’s been a lot of speculation about whether the growth of Seller Central will eventually spell the end of the Vendor model. It won’t.

For one thing, the retail (Vendor) and marketplace (Seller) teams operate independently, and often in competition with each other.

More importantly, Amazon considers the direct relationships it has with certain brands sacrosanct, because of the leverage they deliver in certain categories. In short, Vendor Central is Amazon’s more strategic platform.

Because anyone can open an account on Seller Central, it offers volume – but a lot of the businesses on there are bitty startups. By contrast, Vendor Central is invite-only, and is the home of the big-name, quality brands that ensures Amazon retains its competitive position in core verticals.

Adidas on Amazon; operating as a Vendor

Adidas on Amazon; operating as a Vendor

Vendor Central isn’t going anywhere. In fact, recent moves have demonstrated Amazon’s commitment to the channel, such as expanding their Vendor new business teams, improving learning resources and rolling out new features.

Vendor Central vs Seller Central

Clearly, Vendor Central is a valuable platform. But is it more valuable than Seller Central?

There are several critical differences between Vendor Central and Seller Central, but they’re often explained in very simplistic terms. It’s worth digging a bit deeper into how each one works to understand which channel is the most appropriate for your business model.

For a full run-down of the differences between the two, I’d suggest reading my more detailed article on Vendor Central vs Seller Central.

For now, I’ve highlighted some key areas to be aware of:

Brand

Registration with Vendor Central is by invitation only, for brands who meet certain criteria in terms of turnover, market penetration and so on. By contrast, anyone can register on Seller Central.

Vendor Central offers a range of strategic marketing opportunities for businesses to maximise their brand presence. In particular, larger Vendors are often given preference and key placements when participating in deal ‘events’, such as Black Friday and Prime Day, though both platforms enable brands to create marketing campaigns through advertising, vouchers and deals.

The Amazon Vendor team has the power to prioritise deals from the brands they’re working closely with, during key deal events

The Amazon Vendor team has the power to prioritise deals from the brands they’re working closely with, during key deal events

The Amazon Vendor team has the power to prioritise deals from the brands they’re working closely with, during key deal events

Account Support

Better and more responsive account support is available on Vendor Central than on Seller Central.

On the customer side, Amazon handles all customer service requests for Vendor orders, because they are the retailer. Those on the Seller platform are responsible for responding to customer service requests (unless fulfilment related requests for FBA orders) because they are dealing with Amazon’s customers directly.

On the account side, support tickets filed through Vendor Central are typically responded to quicker and given more attention than those filed through Seller Central. The Vendor suppport form is also simpler to use than the semi-automated version Amazon is pushing on the Seller side.

As there can often be multiple ‘contributors’ to product listing content, Amazon is often resistant to listing updates and changes. Requests from Vendors who are also brand owners have the best chance of changes being accepted, whereas content changes from Sellers are ignored, more often than not.

In addition, new Vendor accounts are supported by a Vendor Manager for the first year. After that, paid account support services are available and once you’re big enough in your category, you’ll come under the radar of a Vendor Manager. No dedicated support is offered to Sellers, apart from some patchy programs that usually end up mothballed.

Supply and fulfilment

The different fulfilment models and Prime delivery options on Vendor Central and Seller Central

On Vendor Central, businesses supply to Amazon on a wholesale basis. Amazon then sells those products to its customers, fulfilling orders automatically from its warehouses with Prime delivery by default.

On Seller Central, businesses sell direct to Amazon’s consumers and are responsible for processing orders and returns themselves, unless they choose to use the FBA (Fulfilled by Amazon) service. Prime delivery is only eligible for FBA offers or if Sellers have ‘Seller Fulfilled Prime’ enabled.

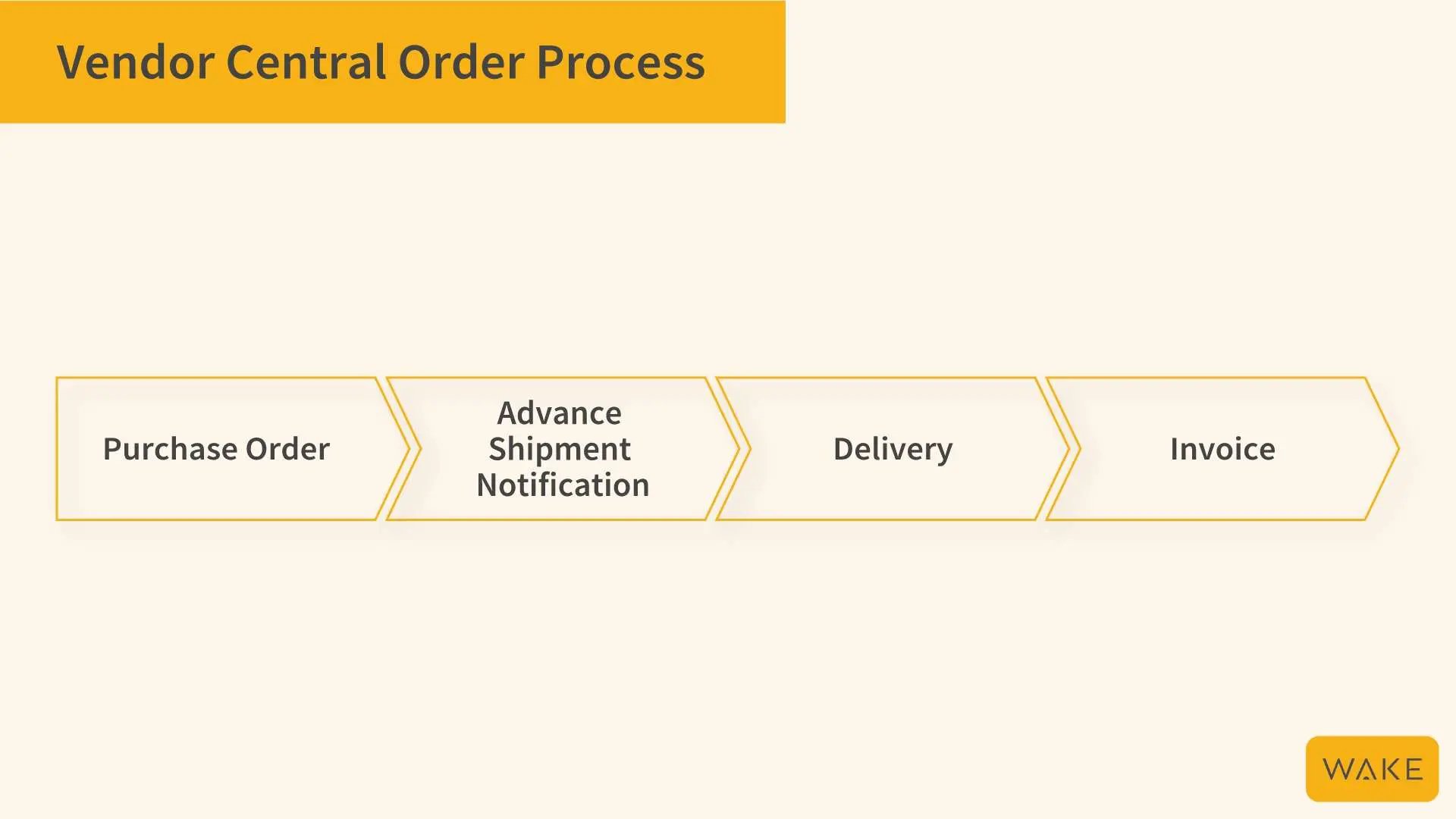

In many ways, the stock aspect on Vendor Central is much simpler than Seller Central because Amazon tell you what stock they want (via a Purchase Order) and you tell them in what configuration you are going to send it to them via an Advance Shipment Notification (ASN). You then deliver it within the specified Delivery Window, and then raise an Invoice (which is typically paid in 60 days). That’s it.

Pricing

Amazon controls the selling price on Vendor Central.

Whilst they will factor in the retail price specified by Vendors when setting up the product, they will reduce the price where necessary to win the Buy Box against other third-party offers, if their profit margin permits. They will also scrape other retail websites to see if their pricing is competitive and reduce accordingly.

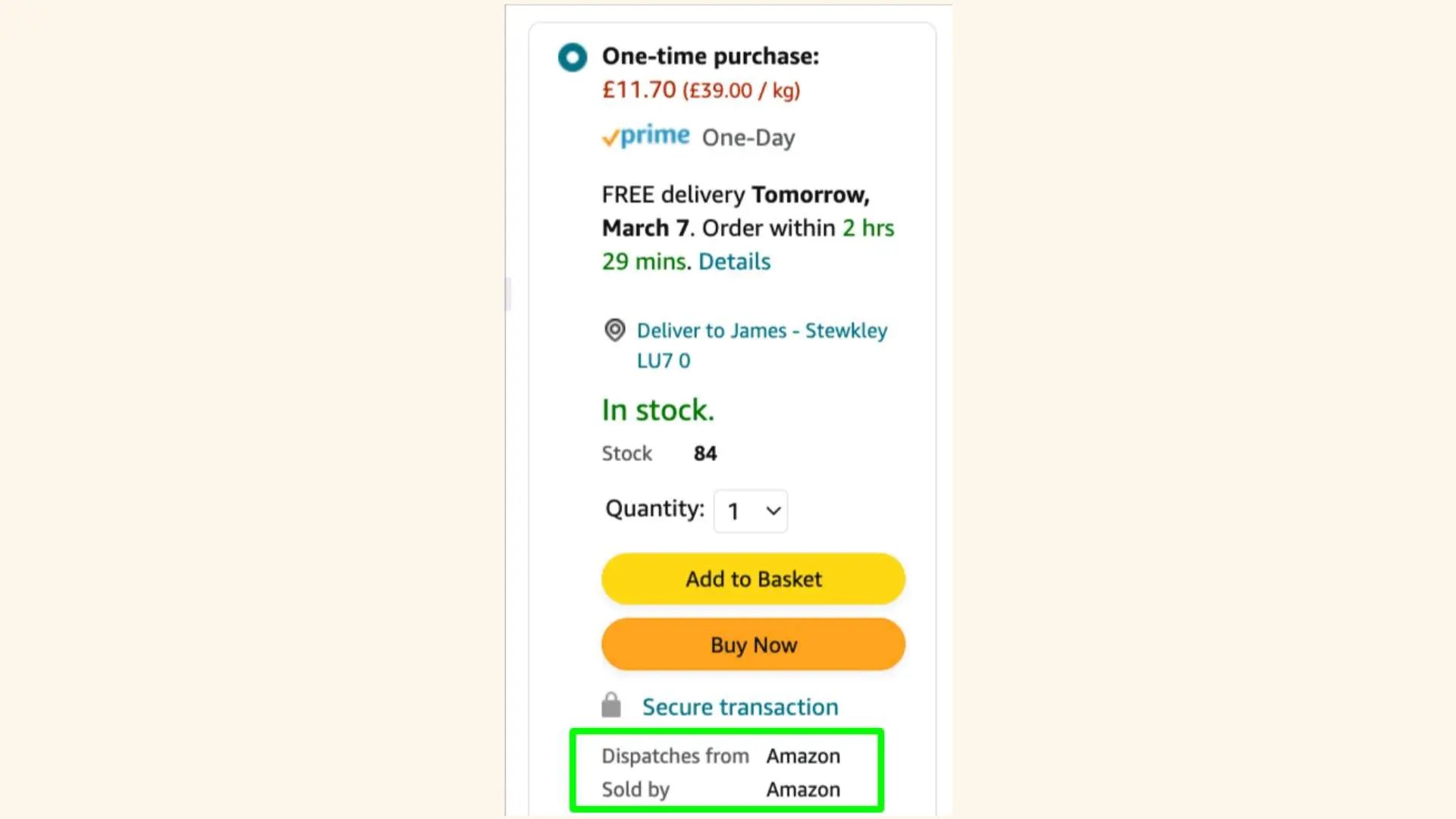

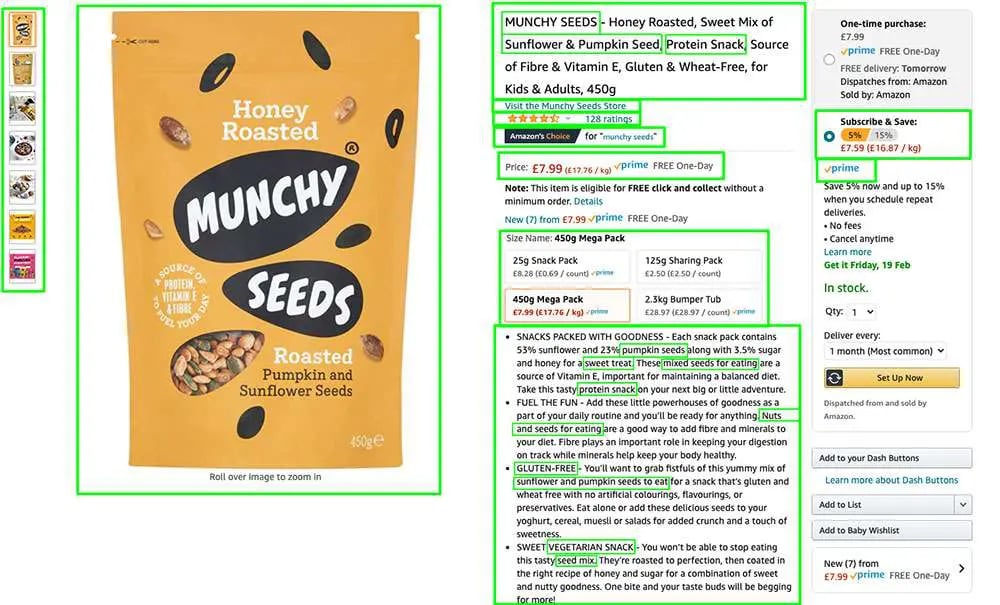

A product must have been sourced via Vendor Central if the Buy Box offer is showing both "Dispatches from" and "Sold by" Amazon

A product must have been sourced via Vendor Central if the Buy Box offer is showing both "Dispatches from" and "Sold by" Amazon

On Seller Central, Sellers set and have control over pricing, but are still competing for the Buy Box against other third party sellers (and potentially Amazon if they are stocking the product).

Whilst Seller Central has been considered the better option for brands controlling their pricing, Amazon has recently made it clear they won’t tolerate brands using it to manipulate their pricing in a way that is not favourable to consumers.

Payments and costs

Vendors agree to payment terms of anywhere between 30-120 days (typically 60 days) when signing up to Vendor Central and can raise invoices once stock has been delivered into Amazon. Sellers receive an automatic payment of the balance in their account every fortnight.

On Vendor Central, commission (known as ‘terms’ or ‘Co-Op’) is agreed on sign up. It’s typically 10%-15% initially, but can be subject to increases and renegotiations on an annual basis.

On Seller Central, each product category has a specific commission structure, which is deducted from any orders received. This is usually in the 7-15% range and rarely increases or changes.

Profitability

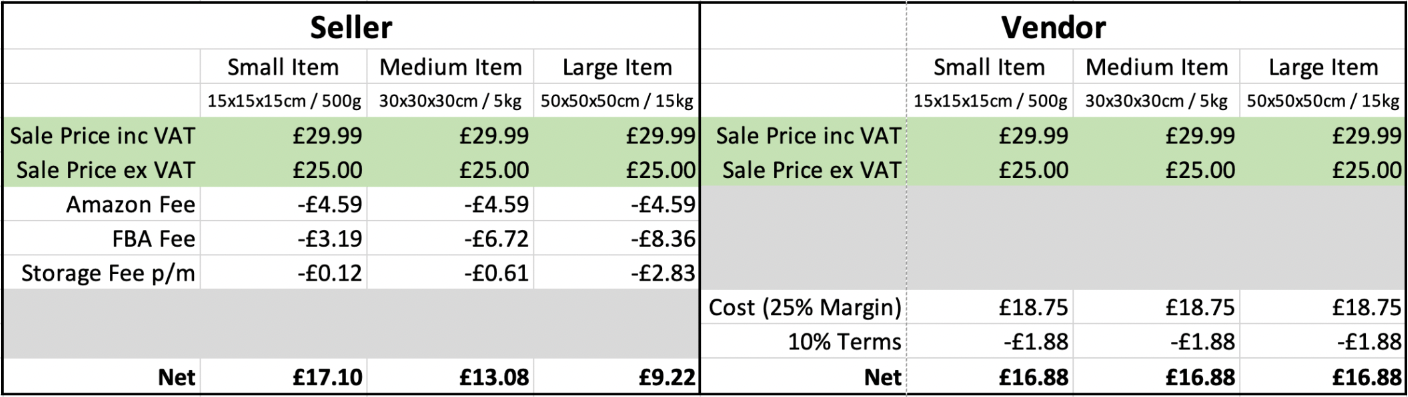

There’s a common misconception that selling via Seller Central will guarantee higher profit margins, because you’re selling at retail pricing, rather than the wholesale pricing structure on Vendor Central.

However, there are additional costs on Seller Central that must also be factored in when judging which channel is going to be more profitable for specific products. Often the crux comes down to a product’s price point, size and weight.

On Vendor Central, Amazon won’t charge you anything that relates to storage, fulfilment and delivery, but on Seller Central these are very much a consideration whether you’re using Amazon’s fulfilment services (FBA) or dealing with this aspect yourself.

In the example below, we’ve compared the cost structure of selling different sized products at the same price point on both Vendor & Seller to highlight the importance of modelling this for both platforms.

Comparing UK profitability on Seller Central vs Vendor Central at a £29.99 selling price. Size & weight has a significant influence on the cost structure when utilising Amazon FBA on Seller Central.

Comparing UK profitability on Seller Central vs Vendor Central at a £29.99 selling price. Size & weight has a significant influence on the cost structure when utilising Amazon FBA on Seller Central.

Who is Vendor Central for?

Hopefully, the above gives you an idea of some of the differences between the Vendor and Seller channels – but even if you’re an established Vendor, it still makes sense to ask the question; who exactly is Vendor Central for?

I often have conversations with brand owners who still don’t fully understand the benefits of the channel, or whether it’s actually best-suited to their business model.

Vendor Managers from Amazon are increasingly reaching out to brand owners, extending them the privilege of becoming Amazon Vendors by ‘inviting’ them to the platform. But as I mentioned, the Vendor team is separate from the Marketplace team – so they’re unlikely to encourage you down the Seller Central route if they already have you in their targets.

To understand if Vendor is the right channel for you, ask yourself the following:

- Are you an established brand owner and/or manufacturer?

- Does your business primarily deal with wholesale customers on a B2B basis, with credit terms?

- Are your products packaged in wholesale formats (in cartons and/or palletised)?

- Are you keen to tighten up the presence of your brand on Amazon, particularly in relation to product accuracy, range availability, price consistency and brand representation?

If your answer is yes to most or all of these questions, it is likely the Vendor model is more suitable for you.

Vendor is a great choice for scaling businesses used to operating on a B2B model, who want to protect and grow their brand, and who want to take a more strategic approach to ecommerce on Amazon.

The Vendor relationship is very much a B2B one when it comes to distribution and logistics, but you’re still firmly in control of merchandising, the buyer experience and representation of your brand

Overcoming challenges with Vendor Central

But there are other criteria to consider when figuring out if Vendor Central is right for you.

As I mentioned earlier (and as you may have already experienced for yourself), the platform can be complex to navigate. Best fit goes beyond aligning your business model – it also depends on your ability to manage some of those challenges.

When I first speak to existing Vendors, the conversation inevitably leads to “what problems are you experiencing?”. Without the relevant expertise or sufficient resource in place to address them, Vendor Central won’t be profitable, or even manageable.

There are six areas that come up time and again. Some Vendors can be extremely efficient in certain areas (such as logistics), but deficient in others (such as merchandising).

Even the best digital marketing or marketplace managers won’t be able to comprehend and tackle all the nuances of the Vendor channel. To drive real growth and outpace your competition, you need to have specialist strategies, expertise and resource in place for:

- Brand

- Catalogue

- Operations

- Marketing

- Data

- Strategy

The key pillars to success on Amazon Vendor Central

The key pillars to success on Amazon Vendor Central

Brand

If your products are in distribution in the wider market, there’s a good chance they’ve already been listed on Amazon by third-party sellers and distributors.

It’s essential you understand the impact of this. It can cause a myriad of issues, including not realising your brand’s full sales potential and reducing its integrity due to weak content and poor buyer experiences.

Brands who are not in control of their products on Amazon are likely to see duplications, inconsistencies, errors and third-party sellers running roughshod with their brand integrity

Questions to ask:

- Are you in full control of your brand on Amazon?

- Are third party sellers in check, or running riot with your listings, pricing, and brand integrity?

- Is your brand being represented accurately and consistently, and to the same standards you would expect on any other sales channel?

Solution

Create a strategic plan to ‘take back control’ of your brand and listings on the channel. This should start with a full audit of which of your products are listed, who is selling them, and research into what you need to do to take ownership of them.

Catalogue

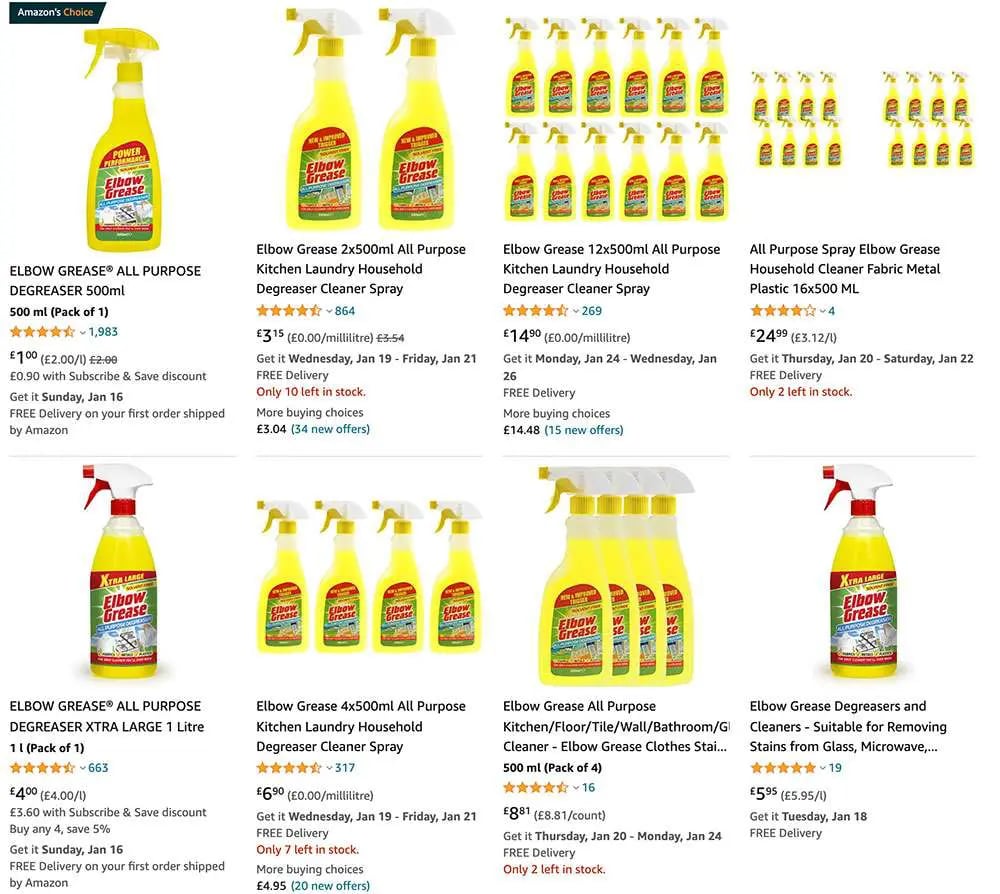

‘List and forget’ worked ten years ago, but not any more, thanks to increased competition and a more sophisticated search algorithm.

You need to be more strategic to drive growth by prioritising products that have the most prospect of success and ensuring, at the very minimum, they are fully optimised.

Your key listings should include high-quality, informative and engaging content that satisfies both your target audience and Amazon’s algorithm (through the inclusion of high quality keywords)

Questions to ask:

- Are your highest opportunity products listed, optimised and being nurtured for additional growth?

- Is your product data accurate, and is the correct information being reflected on your live Amazon Product Listings?

- Do you understand who your direct competitors are, and how you are performing against them?

Solution

Whether your catalogue is large or small, you need to identify the niches that are going to bring you the most success on the channel.

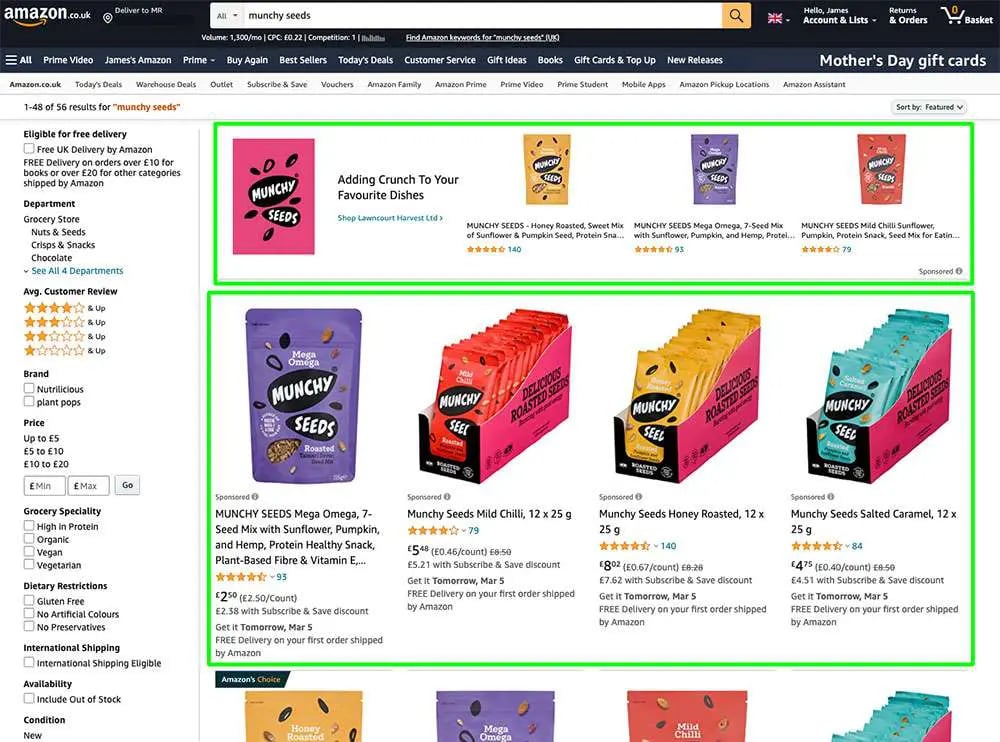

This could be as simple as searching for similar products to yours, and understanding which brands and listings are currently capitalising on those niches.

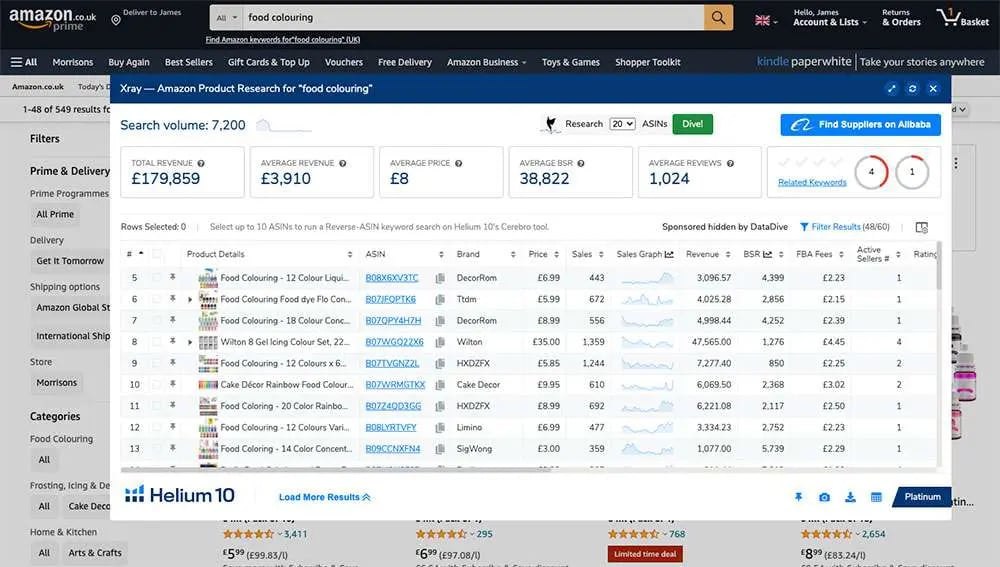

Sophisticated and inexpensive tools such as Helium 10 and Jungle Scout can provide estimated revenue data and sales trends to help you better understand which products and brands are performing.

The Helium 10 Chrome extension provides lots of useful listing data via its ‘XRay’ tool

Once you have a better understanding of which of your products have potential, you can prioritise those with your optimisation and marketing efforts.

The 80/20 rule is cliché, but it seems to be consistently true for the customers we work with. Focus on the products in your catalogue that are driving 80% of revenue and double, triple and quadruple down on them, instead of wasting resources on trying to make your whole catalogue work.

Operations

Business owners often obsess over growth whilst neglecting the thing that can often be addressed more easily: overheads.

This couldn’t be truer than on Vendor Central, where you are confronted with a myriad of ways that Amazon will try to erode your margin: terms, co-op, chargebacks, shortage claims, returns, promotions and advertising to name just a few.

Questions to ask:

- Are you responding to Purchase Orders within 24 hours and processing them accurately?

- Are you getting stock into Amazon on time with the correct information, labelling, carton configurations and palletisation?

- Are chargebacks, shortage claims and other penalties eroding your margin?

Solution

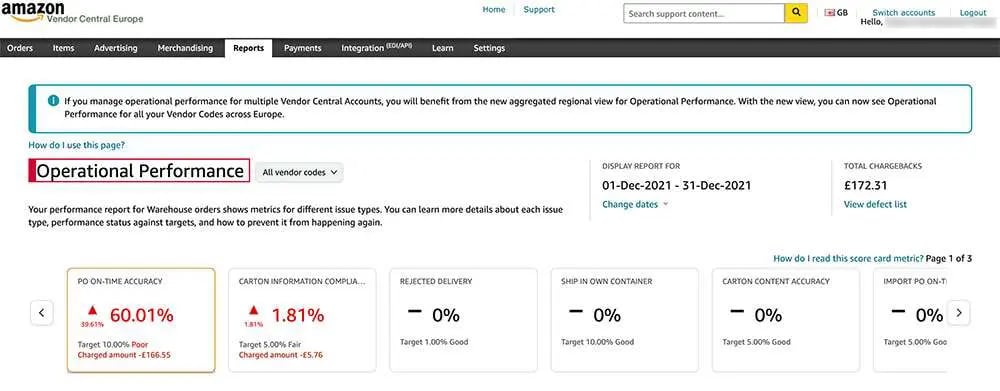

Ensure you’re regularly checking your Operational Performance and Financial Scorecard dashboards in Vendor Central. This will help you to identify the issues that could be eroding your margin early.

Pay close attention to your Operational Performance and Financial Scorecard dashboards

The most common chargebacks relate to late deliveries, inaccurate PO quantities and incorrect labelling – but there are plenty of other charges that Amazon can hit you with if you’re not compliant with their many rules.

You should also look out for Shortage Claims, which Amazon will raise when they think there’s a discrepancy between an invoice you have raised and the stock they have received. Very often they make errors when counting stock in, so it’s important to look at these closely.

Operational issues tend to escalate quickly, so it’s important to identify them and nip them in the bud as soon as possible.

Marketing

Amazon Advertising has become a real money-spinner for Amazon over the past few years. This has resulted in organic results being bumped down the results page, and a myriad of new ad types appearing on practically every page.

Advertising has become an essential component of a cohesive brand strategy on Amazon – but as the marketplace has become more competitive, it has also become more expensive. The best bet for brands is to supplement Amazon advertising with external channels such as Google PPC, social PPC, email and influencers.

Questions to ask:

- Are you engaging in Amazon Advertising, at the very minimum Sponsored Products?

- Are you leveraging deals, promotions, and promotional events?

- Are you exploring how to drive more traffic to your product listings through internal and external marketing activities?

Solution

Ensure you have someone who really understands Amazon Advertising (ideally a PPC specialist), and dedicate some budget to testing different products and ad placements.

Once you find a profitable mix, advertising can contribute to faster account growth and wider brand coverage.

Also consider how you can leverage your other marketing channels to drive traffic to your Amazon listings and store. Engage with your marketing team to ensure they understand the importance of the Amazon channel, and work with them to build omnichannel strategies that drive growth.

Data

Vendor Central is notorious for its complexity, and it can be a struggle to understand how the channel is performing for you, and how much money you’re actually making (or losing).

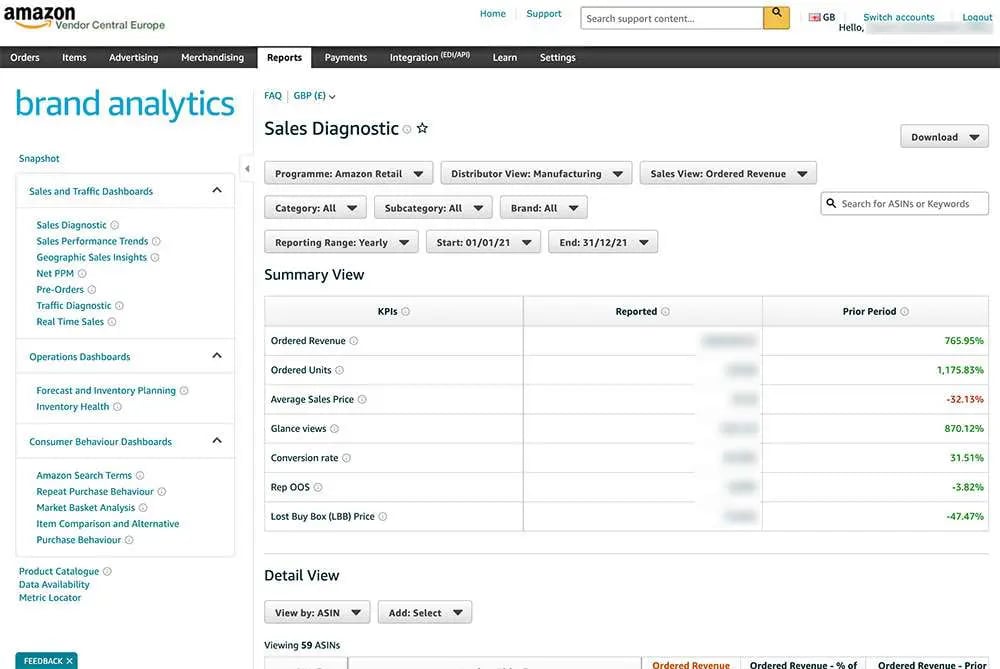

Amazon Brand Analytics provides key metrics in Vendor Central, but it’s not always clear what everything means or what you should be focusing on

Amazon Brand Analytics provides key metrics in Vendor Central, but it’s not always clear what everything means or what you should be focusing on

Questions to ask:

- Do you understand the key metrics for monitoring success on your Vendor channel in relation to purchases, sales, stock, forecasting, listings, traffic, conversion and Buy Box?

- Are you utilising data to make informed decisions about what to stock and when?

- Are you utilising data to get better performance out of your catalogue?

Solution

Build a robust reporting strategy, backed by reliable data. You should be keeping a close eye on basic ecommerce metrics such as sales, traffic and conversion, but also Vendor specific metrics relating to purchases, stockholding, sell-through and operational performance – to name just a few.

Give someone ultimate responsibility over reporting and ensure they have adequate information and understanding to report on the things that matter.

Strategy

Amazon is a demanding channel and it requires enough focus and resource to ensure you’re not just firefighting, but are able to see the bigger picture and how the channel can be driven forward.

Questions to ask:

- Do you have a one-, five- and ten-year strategy for your Amazon channel, and are you fully committed to integrating it into your overall business strategy?

- Does someone in your business have full ownership over driving the Amazon channel forward and measuring its success?

Solution

Give one person in your organisation full ownership and responsibility of your Amazon strategy. Depending on the size of your organisation, this may be their only responsibility.

Who is your ‘Head of Amazon’?

Ensure your ‘Head of Amazon’ is supported by colleagues, external partners or even entire teams that have ownership of the key areas outlined above: Brand, Catalogue, Operations, Marketing and Data.

The more focused people’s responsibilities are, the more you will get out of them.

Making the most of Vendor Central

I started out by saying that Vendor Central is a complicated channel. Hopefully, this guide has cleared up some common misconceptions and helped you understand whether it’s the right channel for your business.

The key points are this: if you can make it work, then it has real potential to become the biggest revenue driver for your brand.

But, it won’t come easily. You must be prepared to invest time and money into the platform, and expect there to be missteps and frustrations along the way. And you must have people with the appropriate knowledge and skills focused on the six key areas outlined. If one or more falls down, it can bring everything else down with it

At WAKE Commerce, we work with brands of all sizes to plug these gaps. We introduce the relevant tools, resources and processes to allow you to grow, whilst also becoming more self-sufficient on the channel over time.

We have spent the last couple of years developing and investing in our own reporting platform for Vendor Central, because Amazon’s reporting is quite simply inadequate, incomplete and opaque.

It gives us a clear view on where revenue is being lost and where more can be made, whilst also keeping tabs on purchases, sell-out, inventory, chargebacks, shortage claims, catalogue, competition and more.

We’re a team of experts committed to demystifying the world’s biggest marketplace, so you can turn Amazon into a more sustainable and brand-focused sales channel.