Wake Commerce Amazon Profit Recovery Playbook 2025

Wake Commerce Amazon Profit Recovery Playbook 2025

As a Vendor on Amazon, optimising your profit margins is a long and complex process.

Amazon chargebacks are often one of the biggest profit drains we assist our clients with. Though many Vendors treat these as minor administrative deductions, letting them go unchecked for too long can quickly bore a serious hole in your margins, and limit your growth on the platform.

The operational landscape of Vendor Central is undergoing a lot of changes in the way chargebacks and other deductions work. This will have profound effects on the way Vendor Central deductions impact your bottom line, and the best methods you can use to minimise them.

In this guide, we’ll explore the incoming changes to Vendor Central deductions, what these mean for your Amazon operation, and how you can react to ensure strong profits moving forward.

A Refresher on Amazon Deductions

Before we investigate how Amazon’s recent changes are going to impact your profit recovery, let’s have a quick refresher on how Amazon deductions have worked up until now to contextualise the new amends.

Amazon has always maintained various types of deductions it can take from your revenues in-line with your vendor agreements. These are usually deducted from an invoice that you’ve raised with Amazon, based on a violation of one of their policies, but can be raised as part of new, adjusted invoices where Amazon charges you for specific infractions.

Amazon can issue different types of deductions depending on the root cause, with each one calling for a different approach to prevent relevant violations or dispute the deductions.

The key types of Amazon deductions are:

Chargebacks: Penalties issued for an error you’ve made in the fulfilment process, for example not submitting the correct shipping documents or packaging your stock incorrectly. This tends to be the most common type of deduction that Amazon issues.

Shortage Claims: Deductions made in response to you failing to send the number of units you’re committed to in a given purchase order. In many instances, this is due to an error on Amazon’s side leading to a discrepancy, rather than the Vendor actually failing to send the correct number of units.

Price Claims: Deductions raised when Amazon flags a discrepancy between a PO price and the relevant invoice price. Though these kinds of discrepancies can come from various elements in the documentation, the dispute process is usually fairly simple, and only requires comparing orders to invoices.

CoOp: Deductions from Amazon CoOp agreements are pre-agreed as part of your professional relationship with Amazon, and should be fairly consistent with every invoice you raise. Having said that, there are often incorrect deductions stemming from your CoOp agreements, for example Amazon charging you a rate when the agreement has expired.

Returns: Amazon may sometimes return units that have already arrived at their fulfillment centres, for example if stock levels don’t meet Amazon’s sales projections, or your products simply being defective or damaged. These kinds of deductions are fairly uncommon, and often require a situation-specific approach.

Minimising Vendor Central Deductions in 2025

A big part of Amazon’s success is owed to its dynamism and flexibility. However, as Amazon changes to coincide with market forces and maximise its profit margins, the climate can become trickier for businesses operating in Amazon’s competitive marketplace.

Recently, Amazon has overhauled many of the rules and conventions surrounding the types of deductions faced by Vendors like you.

Here’s a look at four major changes that are poised to affect your bottom line, and how you can adjust your Amazon operations to adapt.

Significantly Shorter Dispute Deadlines

One of the biggest changes to Amazon’s Vendor Central dynamics are the drastically shortened deadlines you have to dispute deductions such as shortage claims, price claims and CoOp discrepancies.

In April, Amazon shortened the 5 year window you had to dispute these types of deductions by a huge margin. Now, you only can only go back a maximum of 18 months, and the deadline for filing your initial dispute has tightened significantly.

Note that this countdown begins from when an email notification is sent about the chargeback claim, and not when the claim appears in Vendor Central. This makes it crucial to ensure the email address registered with your Vendor Central account is monitored consistently, and you’re disputing chargeback claims as soon as these notifications come up. This way, you’ll secure the right to escalate these disputes at a later date if you need to.

With both chargebacks and changes to CoOp agreements, we’ve noticed that Amazon hasn’t been enforcing the 15-day or one-month window in many cases, and you may still be able to dispute these issues successfully even after the deadline has passed.

Having said that, Amazon employees managing your case can decide to dismiss your dispute due to you being past the allowed time window. To avoid this happening and keep your profit optimisation running as smoothly as possible, it’s still crucial to address disputes as quickly as possible when they arise.

CoOp Billing Based On Real Payments

Up until recently, all CoOp allowances were billed based on the quantity of units that Amazon logged as having received from you. Occasionally, this system would cause gaps between the figure Amazon logged, and the number of units that Amazon paid to the Vendor, leading to overbilling via CoOp allowances.

Now, Amazon has closed the gap by basing their CoOp billing on actual payments, whether those payments are made or just scheduled. This has been a breath of fresh air for many Vendors, creating more accurate billing and removing much of the manual work that comes with fighting unfair or erroneous CoOp charges.

Though CoOp billing becoming more accurate is certainly a good thing for Vendors, it’s crucial to note that Amazon hasn’t retroactively corrected old billing (before June 2024) as part of this update. If you have any past discrepancies from CoOp agreements on your account, it’s likely that you’ll have less than a year to dispute these.

.png?width=750&height=500&name=Blog%20image%20design%2006%20B%20-%20Body%20-%20Small%20Margin%20(1).png)

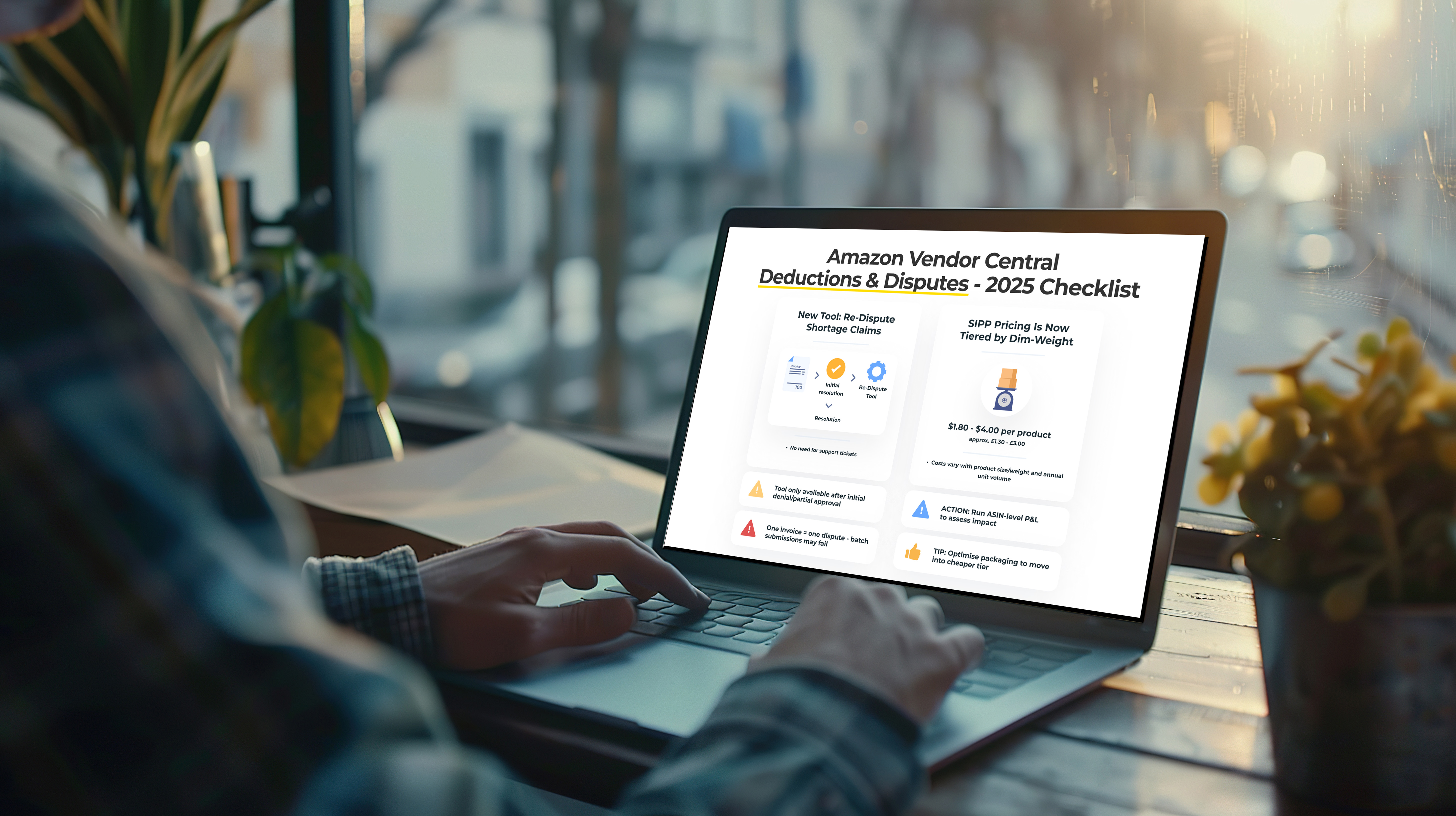

Vendors Can Now Re-Dispute Shortage Claims

In another piece of good news, Amazon has also introduced a new tool giving you the opportunity to revisit Vendor Central shortage claims that have previously been denied, or shortage claims that have only been partially accepted.

Previously, Vendors who wanted to dispute aged shortages would have to raise a support ticket, then chase it and follow up with Vendor support for several months to keep it alive, finally culminating in Amazon settling on an amount to return to you.

Now, you can handle these disputes with a new tool specifically for shortage claim re-disputes, which you can access via: Contact Us > Shortage Disputes > Shortage Re-Dispute Tool.

Having this option is particularly useful in situations where there's a large volume of claims to dispute and Amazon is blanket-rejecting disputes on the first attempt. Escalation was a key part in one profit recovery project where we were able to recover £377,048.05 out of £898,000 in raised claims. Read the full case study here.

While the catch-all Vendor support channel is still available, many Vendors have reported that tickets regarding shortage claims are already being redirected to the new tool by Amazon support agents. This hints at a permanent shift you’ll need to adapt to for all your long-term profit recovery efforts. As the name suggests, however, the Re-Dispute tool is designed for chasing up shortage claims that you’ve already disputed, so you should still start the process by disputing a normal invoice.

Since this change has hit Vendor Central, we’ve heard of many Vendors approaching shortage disputes by uploading batches of several invoices at a time, only to find that if one invoice in the batch is rejected, the rest of them will be too.

Due to this pattern, it’s important that you handle the dispute process with one invoice to one ticket, and avoid risking whole batches being turned down due to a single error.

Price Changes for SIOC

Ships in Own Container (SIOC) has now been rebranded as Ships in Product Packaging (SIPP), a program that comes with an updated pricing model.

Under the old model, Vendors were charged a flat fee per unit for SIOC, regardless of the unit’s size or weight.

With Amazon’s latest wave of updates, you’ll be charged for SIPP on a tiered model, based on the shipping dimensional weight of your units, and the quantity of units that you’re selling each year. Under the new pricing model, US Vendors are being charged $1.80 per product for smaller items, ranging up to $4.00 for larger products (approximately £1.30 - £3.00).

With these changes, some Vendors will see their cost per unit lowered significantly, while others can see them more than double. Speaking to our current and former clients, we’ve found that many Vendors have become comfortable with the standard flat rate charged for SIOC/SIPP, and may not have a full grasp of what these changes will mean for their bottom line.

We strongly recommend anyone who’s been enrolled in the old model of SIOC program to carry out an ASIN-level P&L analysis, check how the new pricing model has affected your catalogue, and ensure that the costs of the program still provide enough value to justify your enrollment.

Similar to the way Seller Central brands approach FBA fees, it’s important to remember that the overall cost of SIPP is directly tied to your products and your product configuration. If you find that the costs of SIPP are becoming prohibitive under the new model, remember to look into the production process and see if there’s anything you can change to move your products to a cheaper tier.

Amazon Profit Recovery FAQs

Changes to Vendor Central’s pricing and programs can take anyone by surprise, and make the task of profit recovery and maximisation even more complex. However, by understanding what these changes mean for you, analysing their impact, and building an effective strategy for the future, you’ll be able to minimise any negative fallout and uphold your bottom line.

Finding it hard to understand the factors affecting your Amazon profits? Our ProfitGuard service offers bespoke profit recovery strategies designed to work within Vendor Central’s changing landscape, and ensure you’re never leaving money on the table.

What are Amazon chargebacks and why do they matter?

Chargebacks are penalties Amazon issues for errors in your fulfilment process, such as incorrect packaging or missing shipping documents. Though many Vendors treat these as minor admin expenses, they can accumulate rapidly and create significant profit leaks if left unchecked.

How have chargeback dispute timelines changed?

Previously, Vendors had up to 24 months to dispute a chargeback. As of April 2025, this window has been reduced dramatically; you now have only 15 calendar days from the date of the chargeback email notification to raise a dispute. Acting promptly is essential to protect your right to escalate if needed.

Can I still dispute a chargeback after the 15-day deadline?

While many Vendors have found that Amazon support still accepts disputes after the deadline, this is not guaranteed. The Amazon employee managing your case may choose to reject the claim due to an elapsed timeframe. For the best results possible, it’s better to handle disputes as soon as they’re raised.

What’s changed with CoOp billing?

Amazon now calculates CoOp allowances based on actual payments made or scheduled, rather than units received. This creates more accurate billing and reduces the need to contest inflated deductions. However, this update hasn’t been applied retroactively to billing before June 2024. If you’ve spotted discrepancies in your older invoices, it’s crucial to act on them as soon as possible.

Where can I find the Shortage Re-Dispute Tool?

You can access it via Vendor Central:

Contact Us > Shortage Disputes > Shortage Re-Dispute Tool.

Note that this tool is specifically for re-disputes, so your initial shortage claim must still be filed via the standard dispute process before you can open a ticket using the new tool.

Can I submit multiple shortage claims at once?

While it's possible to batch invoices in a single dispute, we advise against it. If one invoice is rejected, Amazon may dismiss the entire batch. You should submit claims individually to reduce the risk of avoidable denials.

What is SIOC and how has it changed?

Ships in Own Container (SIOC) has now been rebranded as Ships in Product Packaging (SIPP). Instead of a flat fee per unit, Amazon now uses a tiered pricing model based on the shipping dimensional weight and unit volume. Depending on your catalogue, this new model may cause your costs to go up or down.

Will the new SIPP pricing impact all Vendors equally?

No. Some Vendors will benefit from slightly lower fees, while others may see a sharp increase, depending on product dimensions and sales volume. A thorough ASIN-level profit and loss review is essential to understand how the change affects you.

.png?width=750&height=500&name=Blog%20image%20design%2006%20A%20-%20Body%20-%20Small%20Margin%20(1).png)