Amazon Vendor Central Chargebacks - 2026 Ultimate Guide

Amazon Chargebacks on Vendor Central: The Ultimate Guide

When you first notice an Amazon chargeback on Vendor Central, you may feel a little confused as to how you should approach it.

Though many vendors tend to see chargebacks as just an unfortunate fact of selling on Amazon, these issues can have a major negative impact on your bottom line.

According to cost transformation firm Vendigital, chargebacks have caused a total worldwide cost of £4.8 billion to vendors, and can account for a loss of up to £5,000 for every £100,000 of revenue generated through Amazon.

If you’ve noticed a lot of chargebacks cropping up on your Vendor dashboard, or you just want a contingency plan in place for when they do become a problem, then this guide is for you.

Let’s take a closer look at what Amazon chargebacks are, why they’re important, and how you can maintain a healthier bottom line through effective chargeback management.

What is an Amazon Chargeback?

An Amazon chargeback is a kind of financial penalty Amazon can impose on vendors for violating Vendor Central’s policies.

If something goes wrong in Amazon’s fulfilment process, for example when a vendor delivers a carton that’s overweight or mislabelled, this causes inefficiencies at Amazon’s fulfilment centres which lead to increased costs and delays. When this happens, Amazon will deduct the transaction amount from the vendor’s payments, along with an additional fee that varies depending on the cause of the chargeback.

Some possible causes of Amazon chargebacks include:

- Advance Shipment Notification (ASN) errors.

- Inaccurate carton content information.

- No shows.

- Overweight cartons.

- Late delivery of import documents.

Though chargebacks are a fairly common issue faced by Amazon vendors, the build-up of chargebacks over time can have a serious detrimental effect on your profit margins over time. With this in mind, it’s crucial to understand the mechanics of chargebacks on Amazon, and have a strategy in place to mitigate the risk posed by them.

Why It’s Important to Monitor Amazon Chargebacks

Many vendors tend to think of chargebacks as an unavoidable setback that comes with selling on Amazon. However, the real cost of Amazon chargebacks often go beyond the simple “on paper” cost you’ll see when you receive an Amazon chargeback claim, and chargeback issues could potentially be much worse than they first seem.

Let’s say, for example, that a brand is getting hit by repeated chargebacks for prep issues, due to their product packaging being non-compliant. Beyond the cost of a chargeback on Amazon, this kind of issue can have serious knock-on effects to the other parts of the brand’s supply chain, and increase the risk of negative customer reviews. Ultimately, this would lead not only to higher operating costs, but increase the risk of reputational damage and lost sales on Amazon.

By proactively addressing their packaging issues, and creating internal policies to monitor chargebacks and reduce them as much as possible, this brand can work to minimise chargebacks, secure their reputation, and enjoy long-term operating cost savings.

The Cost of Amazon Chargebacks

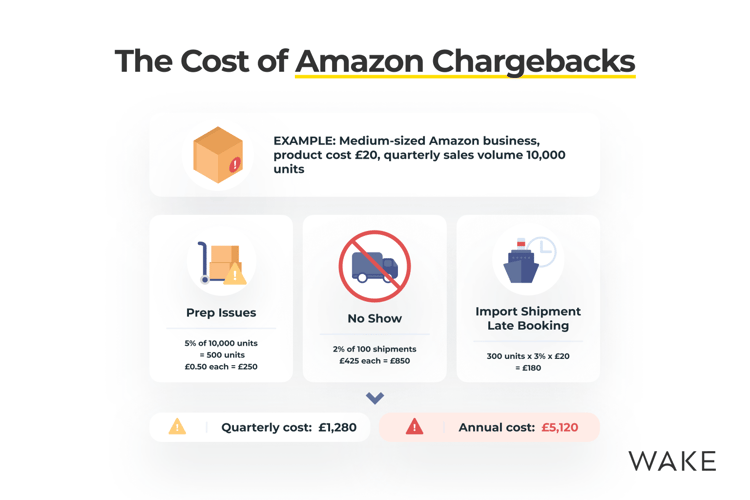

To give you a better idea of how significant the cost of Amazon chargebacks can be, here’s an example scenario to consider.

Imagine a medium-sized Amazon business with an average product cost of £20 per unit, and a quarterly Amazon sales volume of 10,000 units.

Based on the current fees for Vendor chargebacks, here’s a breakdown of what Amazon chargebacks could cost the business based on a fairly small number of incidents resulting in different types of chargebacks:

Prep Issues

Bagged units: 5% of 10,000 units = 500 units.

Chargeback amount: 500 units * £0.50 = £250

No Show

No show shipments: 2% of 100 shipments = 2 shipments.

Chargeback amount: 2 * £425 = £850.

Import Shipment Late Booking

Incidents: 3% of 10,000 units = 300 units.

Chargeback amount: 300 units * 3% * £20 = £180

Though they may seem like minor issues in isolation, if all three of these chargeback incidents were levelled against the business in a quarter, it could lead to a deficit of £1,280, or £5,120 annually.

Want an easier way to manage chargebacks with no upfront investment? ProfitGuard helps you navigate the chargeback dispute process, simplify some of its complexities, and recover hidden profits on Vendor Central.

13 Types of Amazon Chargebacks

There are various compliance issues that Amazon can impose chargebacks for, each one requiring a different response to fix the issue and prevent similar chargebacks in the future.

Here’s a quick look at the 13 types of Vendor Central chargebacks, and what you can do to avoid them.

Advanced Shipment Notification (ASN) Accuracy

ASNs are used to provide the details of a shipment ahead of their arrival at an Amazon fulfilment centre, and any inaccuracies detected by Amazon will always result in a chargeback. To avoid these kinds of chargebacks, it’s crucial to provide on-time and accurate ASNs for every shipment before it’s sent to a fulfilment centre.

Carton Information Compliance

Carton information compliance chargebacks are issued due to cartons being sent without sufficient labelling, labelling with inaccurate information, or labels that are damaged / not scannable. Vendors need to ensure they’re meeting Amazon’s strict labelling requirements.

Carton Content Accuracy

Carton content accuracy chargebacks are issued when an Advanced Shipping Notification provides inaccurate information about the quantity of products in a carton. Similar to your approach to ASN accuracy and carton information compliance, you’ll need to take steps to ensure you’re providing accurate and complete data on carton content when generating ASNs.

Import Documents Late Delivery

For vendors working within a Direct Import model, import documents late delivery chargebacks are imposed when required trade documents aren’t delivered within four days of a shipment’s departure date. To avoid these, you’ll need to maintain a robust system for keeping track of estimated ocean or air freight departure dates, and ensuring that all required documents are submitted on time.

Import PO On-Time Non-Compliance

Import PO on-time non-compliance chargebacks are issued when your estimated cargo delivery falls outside of Amazon’s shipping window as specified in a purchase order. It’s important to make sure any cargo delivery dates you provide are within Amazon’s specified shipping timeframes.

Import Shipment Late Booking

An import shipment late booking chargeback is incurred when vendors fail to submit a shipment booking within three days before the Ship Window Open date for air freight shipping, or 14 days before ocean freight. To avoid these chargebacks, take note of the relevant Ship Window Open Dates and make sure your direct import shipment bookings are submitted on time.

No Show

No show chargebacks occur when a carrier fails to show up during a confirmed delivery slot, without cancelling this appointment in advance. This often occurs when a carrier stores your shipments in their warehouses before their delivery to Amazon, consolidates several orders, and has to change their Amazon delivery slot. To avoid this, vendors should maintain clear communication with their carriers, and make sure any changed delivery dates are accurately booked and cancelled through Amazon's Carrier Appointment Request Portal.

Oversized or Overweight Carton

Oversized carton chargebacks are incurred when you ship a box to Amazon that exceeds specified maximum dimensions (63.5 cm) on any size. Similarly, vendors can be at risk of an Amazon chargeback claim if they deliver cartons above a weight limit of 23kg. Although these chargebacks can be waived if the actual item you’re shipping is naturally larger than the specified limits, generally, vendors should be aware of these limits and ensure boxes don’t exceed them.

Overage PO Units

An overage PO Units chargeback is incurred by vendors who deliver more products than specified in an Amazon purchase order. To avoid these kinds of chargebacks, it’s important to regularly review your product catalogue data, and update any inaccurate information.

Paper Invoice

Paper invoice chargebacks happen when a vendor goes against Amazon’s policies by submitting a paper invoice, or a digital invoice using non-approved channels. To prevent this from happening, it’s essential to submit invoices through the Create Invoice feature on Vendor Central (or via EDI, if you have that set up for automatic invoicing).

Prep Issues

A prep issue chargeback is issued when a product isn’t delivered up to Amazon’s safe shipping standards, covering requirements such as barcode labelling, bagging, bubble wrapping, and more. Be sure to have robust SOPs when it comes to packaging items for shipment, and that all products have the appropriate prep before being sent into Amazon, so they don’t have to do any additional prep work from their end. This is particularly relevant to glass and fragile products, and any products containing liquids (requiring special cap seals and/or additional bagging to prevent leakage).

Rejected Delivery

If your deliveries aren't up to Amazon’s safety or compliance standards, for example using insecure products or unsafely-stacked pallets, Amazon may reject the delivery to their fulfilment centres and issue a chargeback. Be sure to review the delivery safety standards in Vendor Central’s Resource Centre, and take steps to ensure your pallets are delivered in-line with Amazon’s health and safety regulations.

Ships In Own Container (SIOC)

A ships in own container chargeback is issued when products exceed Amazon’s dimension and weight limits (larger than 45.5 x 34.0 x 26.5cm or heavier than 12.3kg), and aren’t certified as SIOC. If you need to ship cartons that exceed these limits, you’ll need to work with Amazon AVS or your Vendor Manager to have your products SIOC certified as early as possible.

2 Ways to Manage Chargebacks on Amazon

With so many potential causes of chargeback claims on Amazon, every vendor needs to have a strategy in place to mitigate their risk and protect their profit margins.

Though the approach you use should reflect the unique needs of your Amazon operation, there are two main approaches to use when looking to minimise chargebacks and secure profits that are rightfully yours:

Partner with a Dedicated Chargeback Manager

One of the easiest ways to minimise the risk posed by a chargeback on Amazon is to partner with a dedicated chargeback manager with plenty of experience working with brands on Vendor Central. They’ll work to monitor your account, dispute fees, and help you navigate some of the more troublesome intricacies of Amazon chargebacks.

When partnering with a chargeback manager, you’ll not only be able to protect your future vendor operations from chargebacks, but also recover lost revenue from previous chargebacks incurred over the past several years.

For many vendors working with limited resources, the idea of hiring dedicated assistance with chargebacks may sound a little expensive. However, many chargeback partners (including ourselves!) only charge a flat percentage of the money they’re able to recover through chargeback disputes, ensuring their services stay affordable and guarantee a positive return on investment.

To find out more about how dedicated chargeback management can help you, check out our ProfitGuard service or schedule a free chargeback audit here!

Manage Chargebacks In-House

Though they certainly don’t make it easy, Amazon does provide recourse for vendors who have been hit by chargebacks, and you can dispute erroneous chargebacks through the Operational Performance section on Vendor Central.

With any chargeback you choose to dispute, you’ll need to gather documents that challenge the chargeback, for example proving that you shipped on time, that you adhered to Amazon’s packaging standards, or that a carton was within a specified dimensions or weight limit.

If you’re shipping a large volume of products, then understanding the details of your chargeback reports and getting your documentation in order can require a lot of time and effort, and you may need to hire an additional accountant or finance manager to manage your chargebacks in-house.

Like partnering with an Amazon chargeback service, having dedicated team members responsible for managing chargebacks will provide a smooth flow of communication and detailed visibility of how much profit you’re able to recover. However, it may be harder to guarantee a positive ROI against their salary or the hourly rate of a freelancer.

However, if you’re looking for a close working relationship with the person who oversees your chargebacks, and you have recurring financial management tasks that could justify a full-time chargeback manager, then forming an in-house strategy could be the way to go.

4 Best Practices for Avoiding Amazon Chargebacks

Though Amazon chargebacks are a fairly common issue faced by vendors, they’re certainly not insignificant, and it’s crucial to have a plan in place for minimising their impact on your bottom line.

Here are four best practices for avoiding Amazon chargebacks and keeping the cost to your business more manageable.

Review and Compare POs

Demand for your products can fluctuate at short notice. With this in mind, it’s essential to actively monitor the trend of demand for your products, and compare this with the volume of purchase orders you receive from Amazon.

Carrying out weekly reviews where you look over your Vendor Central analytics, highlight discrepancies, and plan to adjust your inventory levels accordingly, is an effective habit for averting some of the most common causes of chargebacks.

Keeping active in this regard will help you adjust your inventory according to the level of demand, and avoid chargebacks that can arise from overstocking or understocking.

Optimise Your Operational Efficiencies

Many chargebacks on Amazon are rooted in sub-par operational practices when it comes to handling purchase orders, shipments, and preparation or labelling.

Though you’re probably aware of the stringent shipping requirements for selling on Amazon, when you first get started as a Vendor and see demand pick up rapidly, it can be easy to let operations fall by the wayside with everything else on your agenda.

Some of the steps you can take to optimise your operational efficiencies include:

- Investing in training programs to ensure your operations team is fully up to date on Amazon’s preparation, labelling, and shipping requirements.

- Implementing a stringent quality control process with several layers to ensure every carton is up to Amazon’s standards before it leaves your warehouse.

- Reviewing your WMS and any other technology involved in shipping to Amazon to ensure your order processing is as streamlined as possible.

By reviewing your operations closely, and creating a plan to remove inefficiencies, you’ll be able to eliminate many common errors that can result in a chargeback claim on Amazon.

Keep in Contact With Your Vendor Manager

Keeping in regular contact with your designated Vendor Manager or Brand Specialist (if you have one available) can be a big help in making sure you stay up-to-date on any changes to Amazon’s requirements. Furthermore, regular points of contact give you an opportunity to ask questions and prevent misunderstandings that could increase the risk of chargebacks.

If you haven’t already, try to schedule a recurring meeting with your main Amazon contact, then proactively prepare for these with important updates from your end, along with any questions that might help you align your shipping operations with Amazon’s requirements.

As you build a rapport with your Vendor manager and keep engaging in open communication, you’ll both keep updated on potential issues as soon as they arise and be better-equipped to resolve them quickly.

One word of warning though; Vendor Managers and Brand Specialists typically will refuse to get involved in the resolution of specific chargeback cases.

Get Familiar With Amazon Vendor Analytics

Though it may not be the most intuitive platform in the world, Amazon’s Vendor Analytics and Operational Performance dashboards have plenty of data that can help you identify issues as they arise and monitor performance over time.

By getting comfortable with these reports, you and your team will become more adept at identifying trends and patterns that could help you optimise your Amazon operation.

Using this kind of data to align your Amazon strategy with market forces, you’ll be able to stay ahead of the curve and reduce the impact of chargebacks.

Beating Amazon Chargebacks

Though some businesses can fall into a habit of seeing chargebacks as just another part of doing business on Amazon, it’s important not to underestimate how expensive they can become if left unchecked.

We hope this guide has given you a better idea of how Amazon chargebacks can arise, why they should be avoided, and the steps you can take to mitigate chargebacks’ effect on your Amazon profit margin.

If you’d like more support with minimising your risk and recouping some of the cost of chargebacks with no upfront investment, schedule your free ProfitGuard audit today!

Amazon Chargeback FAQs

What is a chargeback claim on Amazon?

Amazon chargebacks are financial penalties Amazon applies for violating Vendor Central’s operational policies, for example carton prep standards or weight and dimension limits. Chargebacks used to cover the operational cost of these violations on Amazon’s part, and incentivise vendors to stay compliant.

What are some common causes of Amazon chargebacks?

The most significant causes of Amazon chargebacks will vary greatly from one business to the next depending on their operational processes. However, some common causes of chargebacks that all vendors should be aware of include:

- Advance Shipment Notification (ASN) errors.

- Inaccurate carton content information.

- Lack of product prep (for fragile products, for example).

- No shows.

- Overweight cartons.

- Late delivery of import documents.

How can I manage chargebacks effectively?

Some of the best ways to manage chargebacks on Amazon and avoid excessive penalties include:

- Using a dedicated chargeback management service like ProfitGuard to delegate chargeback management to a team of experienced professionals.

- Tackling chargebacks in-house, either by finding the bandwidth yourself, hiring a permanent financial manager, or outsourcing to freelancers.

Can I dispute an Amazon chargeback?

Yes. Vendors can dispute chargebacks through the Operational Performance dashboard on Vendor Central. To succeed, you’ll need supporting documentation that proves compliance - for instance, shipment records, packaging proof, or invoices that meet Amazon’s requirements.

What’s the difference between a prep issue and a packaging compliance chargeback?

A prep issue occurs when products don’t meet Amazon’s safe shipping requirements (like missing bubble wrap or bagging). Packaging compliance chargebacks, on the other hand, usually stem from labelling errors, damaged labels, or missing carton information.

How much documentation should I keep for chargeback disputes?

It’s best practice to keep thorough records of invoices, ASN submissions, shipping confirmations, and carrier communication for at least 12–18 months. The more detailed your records, the stronger your case will be in disputes.